Simplicity at Its Finest: Minimalistic Website Design Inspiration

July 28, 2024

The Best Examples of Gadgets Websites

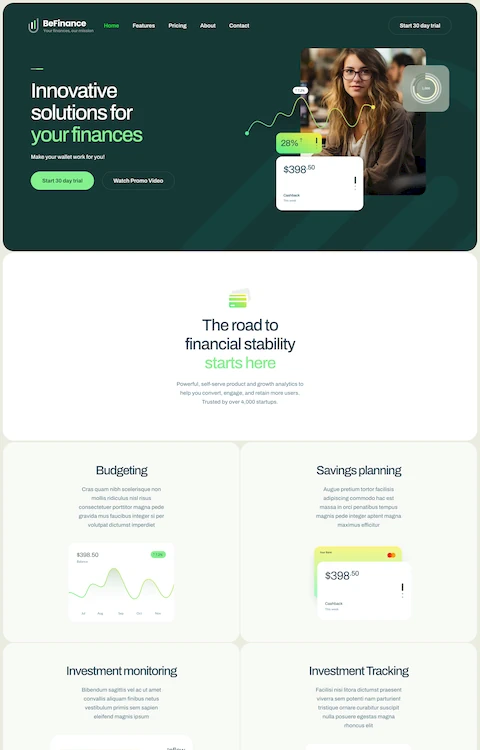

August 6, 2024A fintech website's design will either captivate or lose a potential client within seconds.

Imagine navigating a digital banking platform that seamlessly blends usability with aesthetic finesse.

This is the hallmark of excellent fintech website design—a perfect union of User Experience (UX) and User Interface (UI) design principles tailored specifically for financial technology platforms.

What sets successful fintech web designs apart is not just their stunning interface aesthetics, but also their usability and intuitive navigation.

From mobile banking app designs to investment platform interfaces, we’ll explore prime examples that illustrate these features.

By the end of this article, you’ll discover inspirational examples of fintech website designs, along with key insights to implement in your own projects.

Expect an exploration of modern fintech interfaces, payment solutions, and personal finance dashboards. Through this lens, we’ll unlock the secrets behind the most effective, user-friendly fintech websites.

Prepare to delve into the intricacies of fintech design that not only look good but also drive user engagement and trust.

Fintech Website Design Examples

Visa

Visa sparks payment innovation, empowers economies, and strives to provide financial access to underserved markets. As the exclusive Payment Technology Partner for the Paris 2024 Olympics, Visa unites athletes and fans. Their commitment to improving the global financial landscape is evident through their extensive range of services designed to uplift everyone, everywhere.

Mastercard

Mastercard is a global technology leader in the payments industry, offering innovative solutions to connect and power a sustainable and inclusive digital economy. They provide secure, convenient, and efficient payment solutions to individuals, businesses, and governments, enhancing financial inclusion and economic growth worldwide.

Intuit

Intuit, known for QuickBooks, TurboTax, Credit Karma, and Mailchimp, provides innovative financial solutions. They aim to empower individuals and small businesses with tools for financial confidence and success. Their services include tax preparation, accounting software, personal finance management, and marketing tools, ensuring comprehensive financial support.

Belottie

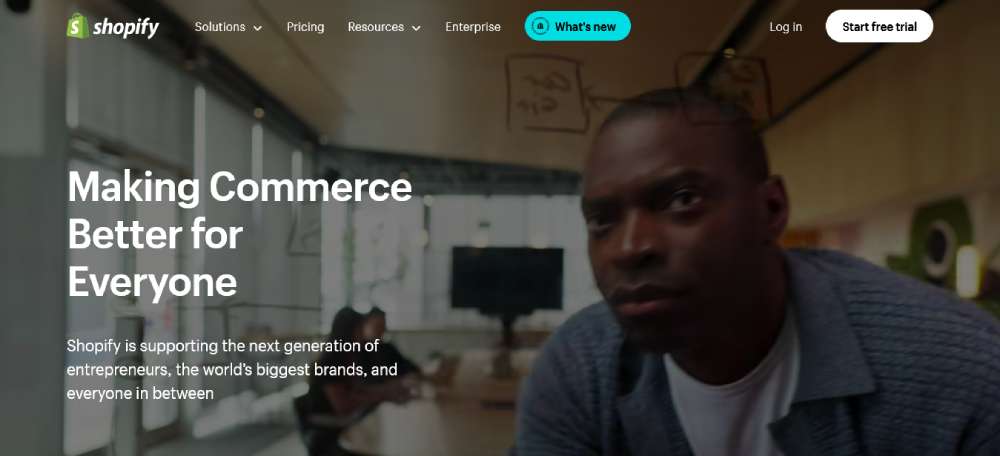

Shopify

Shopify enables millions of merchants worldwide to build and grow their online stores. Their platform offers customizable templates, integrated marketing tools, and a reliable checkout system. With Shopify, businesses can sell online, in person, and across the globe, supported by a robust infrastructure that simplifies business operations.

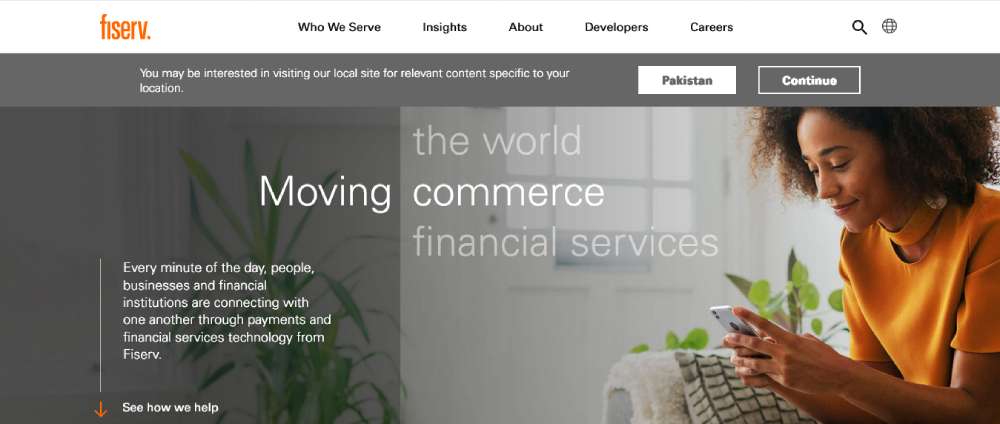

Fiserv

Fiserv drives commerce through its omnichannel ecosystem, Carat. They offer innovative digital financial services to help consumers manage their money, enable small businesses to grow, and create fintech solutions. Committed to community support, Fiserv has dedicated $50 million to aid Black- and minority-owned businesses.

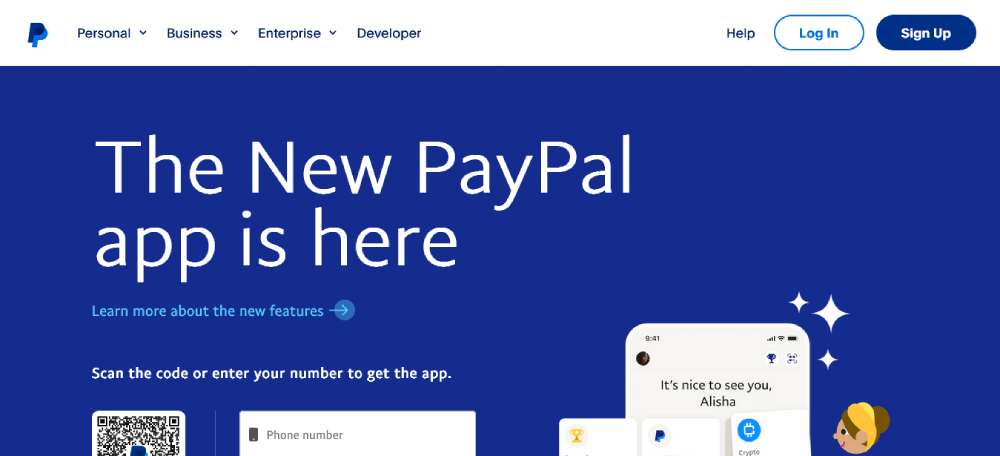

PayPal

PayPal offers a secure, private, and versatile digital wallet, enabling fast, safe transactions. Users benefit from cash back rewards, high-yield savings, and the ability to settle up with friends quickly. PayPal’s app integrates various financial services, ensuring users can manage their money with ease and peace of mind.

Stripe

Stripe powers millions of businesses by providing a comprehensive financial infrastructure. They facilitate online and in-person payments, support custom revenue models, and enhance business efficiency. Stripe's platform is designed to reduce costs, grow revenue, and streamline operations, making it an essential tool for businesses of all sizes.

Adyen

Adyen offers an all-in-one financial technology platform for payments, data management, and financial control. Businesses can accept payments globally, protect revenue, and manage finances seamlessly. Adyen's solutions cater to various business models, providing insights, fraud protection, and optimized financial operations.

Beitservice5

Block (formerly Square)

Block is an innovative financial services and mobile payment company dedicated to empowering businesses of all sizes. Their ecosystem includes tools for managing sales, customers, employees, and finances. Block's platforms, such as Square for payments and Cash App for personal finance, are designed to help businesses thrive and individuals achieve financial independence.

Checkout.com

Checkout.com provides a global platform for digital payments, offering transparent pricing and dedicated support to boost acceptance rates and fight fraud. Their single API integrates a suite of payment capabilities, enabling businesses to accept payments, manage funds, and protect against fraud with ease, all while optimizing performance and revenue.

Afterpay

Afterpay revolutionizes the way consumers shop by allowing them to buy now and pay later. Users can manage their budgets by paying in four interest-free installments. Available online and in-store, Afterpay partners with top brands like Nike and Macy's, offering a seamless shopping experience without fees when payments are made on time.

Chime

Chime offers a tech-forward approach to banking with no monthly fees, overdraft protection, and early direct deposit. Their user-friendly app provides tools for managing finances, building credit, and accessing a network of 60,000+ fee-free ATMs. Chime's focus is on helping users achieve financial health and control over their money.

Acrisure

Acrisure connects entrepreneurs with insurance and business solutions. They offer personalized insurance for individuals and businesses, including home, auto, life, and commercial insurance. With a commitment to innovation and global capabilities, Acrisure helps clients achieve their goals by providing comprehensive, customized coverage.

Befinance4

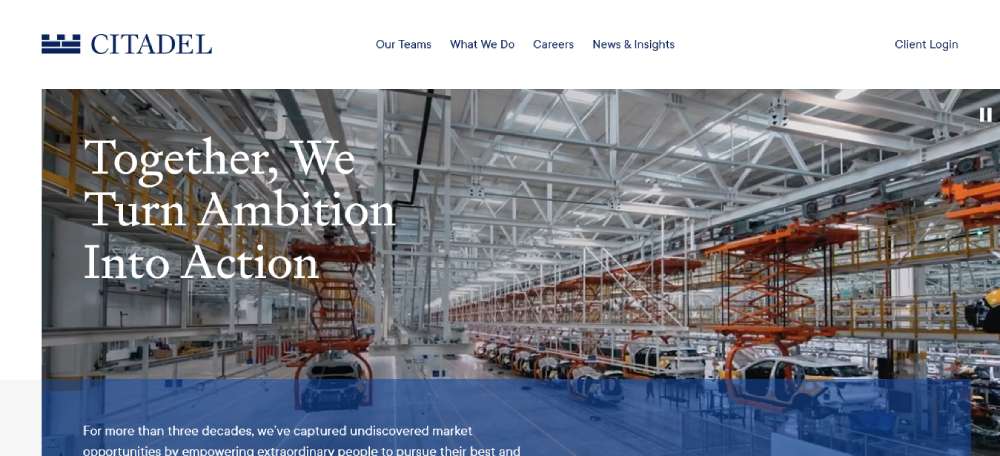

Citadel Securities

Citadel Securities is a leading global market maker that identifies the highest and best uses of capital. Founded by Ken Griffin, Citadel manages $63 billion in investment capital and is renowned for its innovative strategies and technology. They strive to generate superior long-term returns for public and private institutions through relentless pursuit of market opportunities.

WeBank

WeBank is China's leading digital bank, providing inclusive financial services to individuals and businesses. As a pioneer in fintech, WeBank focuses on leveraging technology to offer accessible and efficient banking solutions, ensuring financial inclusion and innovation in the banking industry.

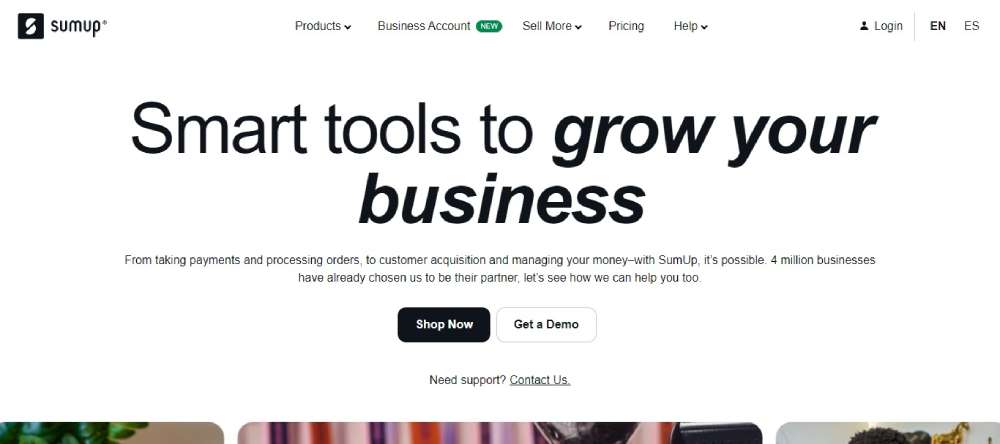

SumUp

SumUp empowers businesses with smart payment solutions and POS systems. Their tools help manage sales, customer acquisition, and finances. SumUp offers card readers, business accounts, and POS systems designed to streamline operations for restaurants, retail, and service industries, ensuring seamless transactions and customer loyalty.

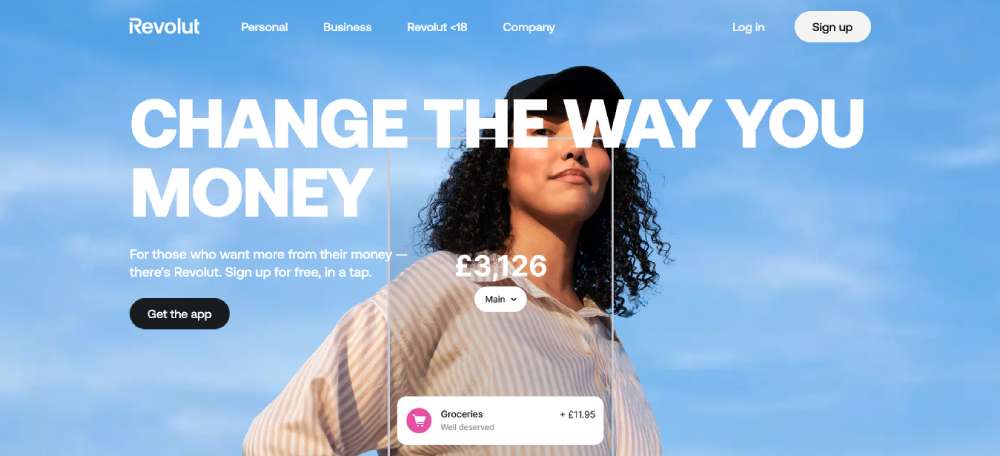

Revolut

Revolut offers a comprehensive financial app that includes banking, budgeting, and cryptocurrency services. Users can manage their money across multiple currencies, invest in stocks, and trade cryptocurrencies. Revolut's platform is designed to provide flexibility and control over personal finances, with a focus on innovation and customer satisfaction.

Robinhood

Robinhood democratizes finance by offering commission-free trading of stocks, options, and cryptocurrencies. Their platform includes tools for investing, earning interest on uninvested cash, and managing financial portfolios. Robinhood aims to make financial markets accessible to everyone, providing educational resources and a user-friendly experience.

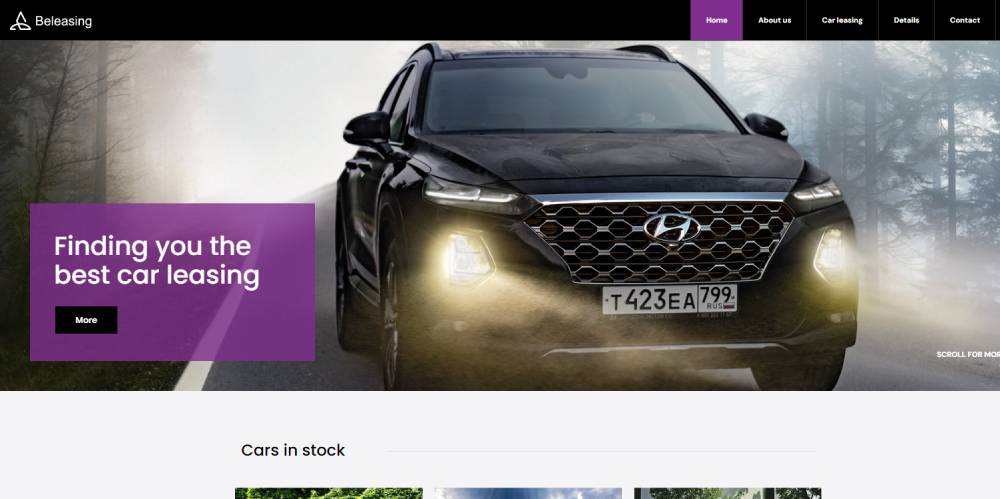

Beleasing

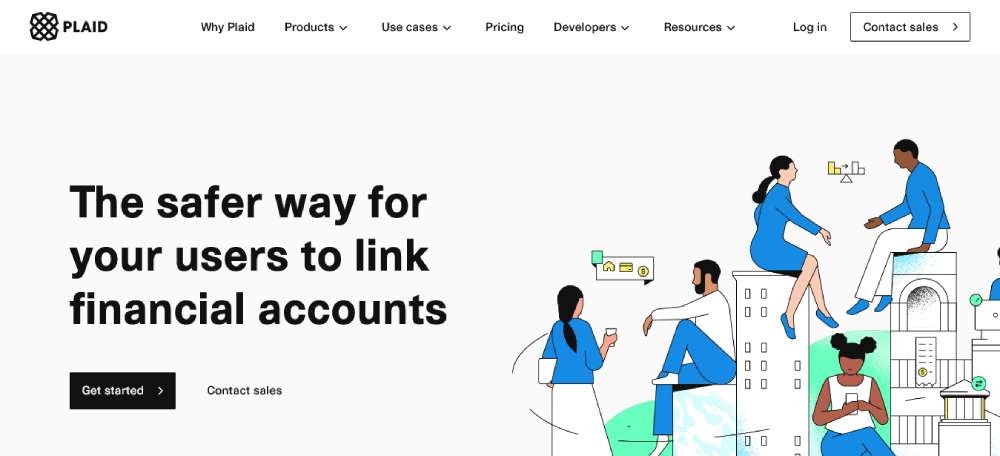

Plaid

Plaid connects financial accounts with applications seamlessly and securely. Their API-first network powers over 7,000 apps and services, enabling users to link accounts from more than 12,000 financial institutions. Plaid's products enhance financial offerings by providing tools for account verification, transaction analysis, and fraud prevention, driving growth and innovation in fintech.

FAQ On Fintech Website Design

What are the essential elements of a great fintech website design?

A top-tier fintech website design needs a user-friendly interface with clear navigation. Prioritize mobile responsiveness and intuitive dashboards.

Add strong visual aesthetics and fast-loading pages. Don’t forget secure payment solutions and seamless integration with other financial services. Aim for a balance of functionality and design.

How can I improve user experience (UX) on fintech websites?

Enhance user experience by streamlining navigation and minimizing load times. Use clear CTAs and concise text. Personalize the user journey through data-driven insights.

Employ visual cues and interactive elements to simplify complex financial services. Consistent user feedback mechanisms ensure perpetual improvements.

Why is mobile responsiveness critical for fintech websites?

Mobile responsiveness is non-negotiable. Fintech users are frequently on-the-go, accessing digital banking apps, and payment solutions via smartphones.

Responsive design ensures a seamless experience, unpacking complex interactions into accessible formats, bolstering engagement and satisfaction, while expanding user reach and fostering loyalty.

What are the latest trends in fintech website design?

Current trends highlight minimalistic design, dark mode interfaces, and micro-interactions. AI-powered insights, voice-assisted navigation, and personalized user data visualization are gaining traction.

Clean typography, bold colors, and immersive 3D elements also define the cutting edge of fintech website aesthetics.

How do security features impact fintech website design?

Security is paramount in fintech design. Incorporate multi-factor authentication, data encryption, and secure payment gateways.

Transparent privacy policies and security certifications build trust. Seamlessly integrate these elements without compromising the user experience, ensuring peace of mind for your users.

What role does content play in fintech website design?

Clear, engaging content communicates complex financial concepts simply. Use infographics, explainer videos, and detailed blogs to guide users.

Consistent content updates foster trust and establish your site as a reliable resource. Content also supports SEO, enhancing visibility and attracting organic traffic.

How can I make a fintech website more visually appealing?

Blend clean design, high-quality images, and modern typography. Use a cohesive color scheme aligned with your branding.

Interactive elements and animations can enrich visuals. Ensure elements like charts and dashboards are aesthetically pleasing and informative, striking a balance between form and function.

Why is fast load time important for fintech websites?

Fast load times are imperative. Users expect immediate access to information, especially when dealing with financial transactions.

Speed enhances user trust, reduces bounce rates, and improves SEO rankings. Optimize images, utilize CDNs, and streamline code to achieve optimal performance.

How do you integrate fintech services seamlessly into a website?

Seamless integration involves using API connections for real-time data access. Ensure that all fintech services like investment platforms, crypto exchanges, and payment solutions communicate efficiently.

Consistent interface design helps users navigate between sections without feeling disoriented or overwhelmed.

What are some common mistakes in fintech website design?

Avoid complex navigation and heavy loading times. Overlooking mobile responsiveness and accessibility can alienate users.

Steer clear of unnecessary data fields in forms. Miscommunicating financial services or having unclear CTAs can deter engagement. Always prioritize user-centric design and continuous improvement.

Conclusion

In wrapping up our exploration of outstanding fintech website design examples, consider the essential elements we’ve dissected. Crafting user-friendly interfaces with intuitive navigation and eye-catching visual aesthetics isn't merely about good looks—it’s about functionality and security.

Integrating responsive designs and leveraging the latest UX/UI trends, like dark mode and micro-interactions, can set your platform apart. Remember, fast load times and seamless integration of financial services such as investment platforms and payment solutions are critical.

Above all, prioritize user experience. Use clear, engaging content and provide robust security features. Strive for a balance that encourages trust and enhances usability. A well-designed fintech website can turn complex financial technology into an accessible, engaging, and secure experience for your users.

In essence, a meticulously crafted fintech website pairs sophisticated design with functional precision, providing not just aesthetic pleasure but practical utility. This fusion is what ultimately drives user engagement and trust, setting your financial platform on a path to success.

If you liked this article about fintech website design, you should also check out this one about the best consulting websites.

We also have similar articles about the best dentist websites, barbershop websites, car wash websites, charity website design, event planner website design, construction website design, websites for singers, and the best actor websites.

Yep! We really like websites, especially when we build them with BeTheme and the BeBuilder.